Submitted by Jon Reed on

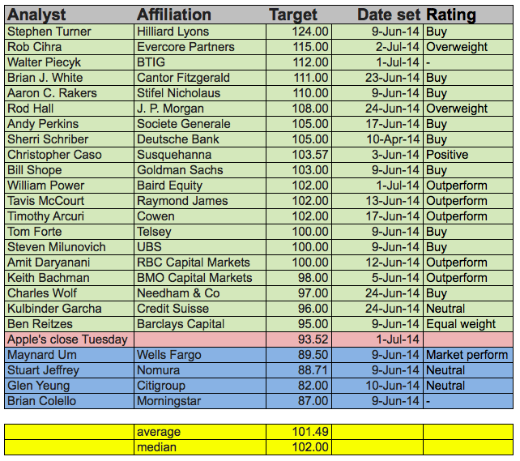

A year ago, Fortune conducted a survey of 45 financial analysts and found that only four of them (about 9%) thought that Apple (NASDAQ: AAPL) shares would rise above $700, the record high set in September 2012. Since then, many have pulled an about face and raised the target price to new highs.

Fortune recently surveyed the same analysts and found that 64% have now set their target prices above $100 (equivalent to setting it above $700 pre stock split). This is likely due to several factors including Apple's aggressive stock buy back initiative, better than expected Q2 numbers, a number of upcoming product launches including the large screen iPhone 6 models, iWatch and new iPads, expansion in

overseas markets, and acquisitions of successful brands like Beats Music.

Just this week, Evercore analyst Rob Cihra raised his target price from $100 to $115. In a note to investors he wrote that Apple is "creating its own growth through uniquely innovative hardware+software with integrated services vs. a sea of otherwise commodity devices." He believes the next generation iPhone will sell in the realm of 58 million devices in the December quarter. Walter Piecyk of BTIG raised his target price a whopping 30%, from $86 to $112, one of his reasons:

Last week, J.P. Morgan raised its target price from $89 to $108. We won't be surprised to see more of the same from other analysts over the next week or so.Historically we estimate that ~20% of AT&T’s subscriber base was eligible for an upgrade during an iPhone launch quarter. That eligibility dropped to a low of the mid-teens in the second half of 2013 due to the stricter upgrade policies. We expect AT&T’s new Mobile Share Value plan to increase the percentage of AT&T post-paid subscriber base eligible to upgrade to over 65% by the time the next iPhone launches. In absolute terms that is the difference between 10 or 11 million eligible for upgrades and 45-50 million.