AAPL News Recap 4/13 - 4/20

Submitted by Jon Reed on

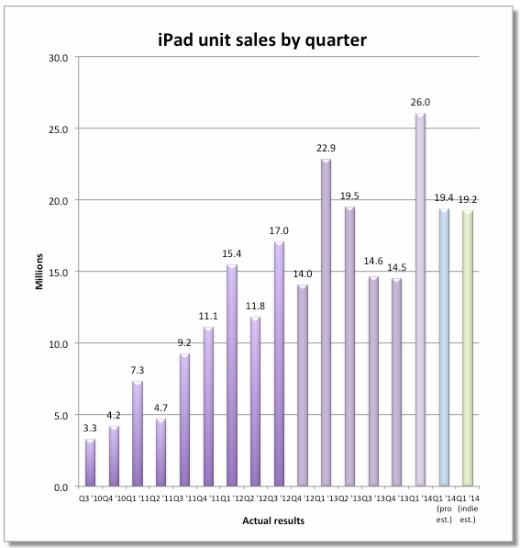

AAPL shares value had a relatively uneventful week last week, opening at $521.68 on Monday 4/14 and closing at $524.99 on Friday. This week should be more eventful since Apple will be releasing its Q2 FY 2014 earnings report at 5 PM Eastern this coming Wednesday, 4/23. You can access an audio webcast of the announcement at Apple's Investor Relations page.

Apple's Q2 guidance that was released in late January (and promptly caused the stock price to tumble) called for revenue between $42 and $44 billion. Fortune's poll of analysts returned an average revenue estimate of $43.5 billion. Many of