Submitted by Jon Reed on

Saving money, whether just in general or for a specific future purchase, is likely something that is on most people's minds. There are a lot of apps that will help you gain perspective on your spending habits and give you suggestions as well. Other apps will simply motivate you to save with daily reminders to set some money aside and info on your current balances. There are even apps that will invest your spare cash in the market if you aren't happy with the ~.03% your savings account accrues. Here are four apps that you might consider if you want to grow your nest egg:

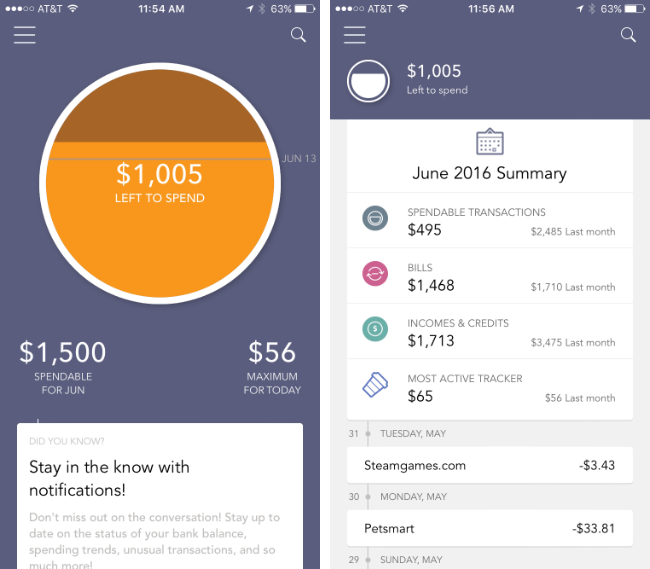

Level

Having a monthly, weekly or even daily budget is a good way to start, but before that, you need to have a good idea as to just where all your cash is going. Perhaps you have an inkling that you're spending too much money on your morning coffees or you are eating out too much. Maybe you have a few small recurring fees like Netflix or Spotify that are adding up to a substantial amount. The first step in planning a budget is gathering all this information and getting the full perspective, then you can start reducing your spending and cutting items out. Level will give you a bird's eye view of your spending habits and let you know how much money you have left to spend. Link it to your checking, savings and credit card accounts, enter your recurring income and bill payments, and start tracking. The interface is basically a feed that shows you what your day to day expenses are and how much you have left to spend each day, based on a limit that you set. A particularly useful feature allows you to track purchases by type, so for example, you could create a tracker to show you how much you are spending at convenience stores, coffee shops, etc. by giving Level example transactions, then the app will automatically track any similar purchases. You can also flag unique, big ticket purchases so they don't skew your budget.

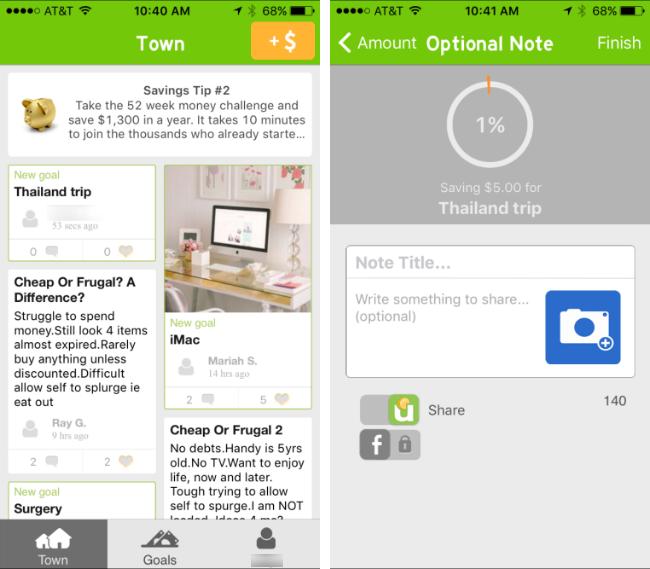

Unsplurge

Whereas Level helps you establish a budget and stick to it, Unsplurge focuses on specific goals and hosts a community of other savers who can help inspire you. You simply enter what you're saving for and a goal amount of money, then you let the app know every time you set aside money for it. It will keep track of how far along you are and others can "like" and comment on your activity, and you can do the same for them. The social media atmosphere is intended to motivate you to save, as are challenges such as the 52 week savings challenge in which you put $1 aside the first week, $2 the second and so on until after 52 weeks you've saved over $1300.

Newest iPhone FAQs

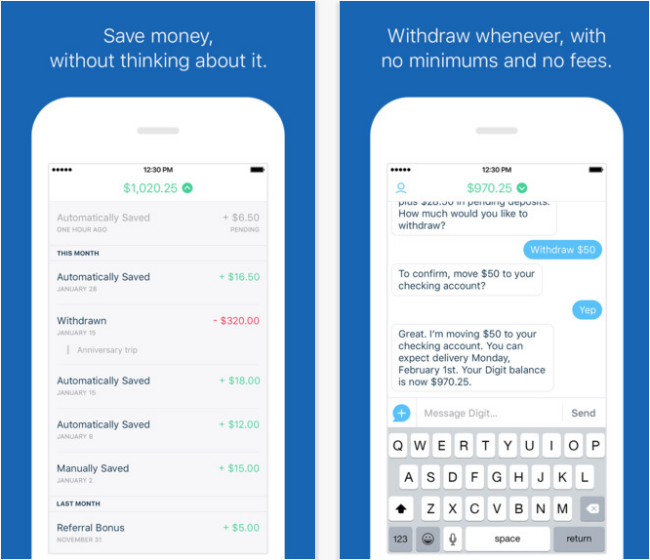

Digit

Digit is an actual savings account itself and is a great way to save money without having to put too much effort into it. When you sign up you get a Digit savings account and you link it to your bank checking account. It then learns your spending habits and automatically transfers small amounts of money (typically $2 - $17) every few days to your Digit account. It also sends you one text a day to inform you of your checking account balance and activity, which lets you avoid the tedious task of logging into your bank account daily. The app is completely free and you get unlimited transfers. If you need your money you can transfer it back to your bank account within a business day. It has a no-overdraft guarantee so you don't need to worry about that, the only downside is that your savings make next to no interest - every three months you get a "Savings Bonus" of 5 cents per $100.

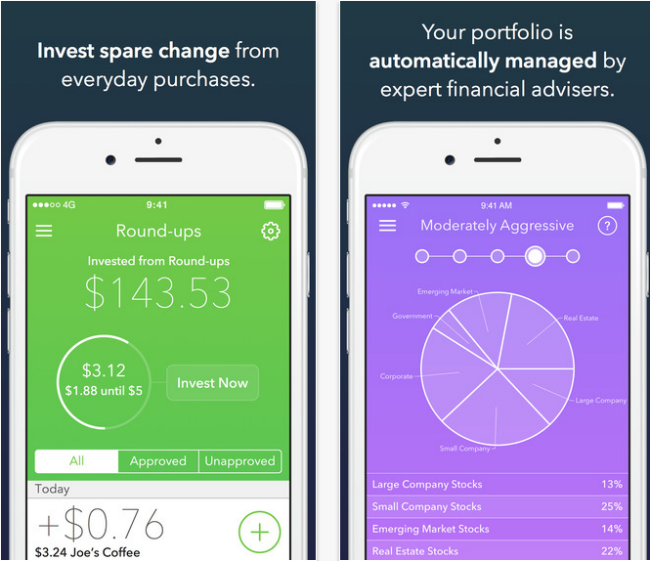

Acorns

Acorns is a bit different from the other entries in this list in that it invests your spare money for you. You link your debit and credit cards to your account and whenever you make a purchase it rounds up to the next dollar and deposits the spare change into your account. You set your investment approach in terms of aggressiveness and it does the rest, diversifying your investment over stocks, bonds and real estate. You can also set up recurring deposits and you can withdraw any time you want. The caveat is that you can lose money if the market goes south, and there is $1/month fee for accounts with less than $5000.

Comments

Many replied on Permalink

Hello guys, i wanted to share with You an amazing tutorial on how to create iPhone & iPad Games and Apps. This will help You Create an iPhone or iPad App or Game in 4 weeks & Hit Pay Dirt With It In The App Store With No Programming Skills: http://25b277camw9wgqayqrzamhqrt0.hop.clickbank.net. The course helps to easily make extra income on the side of your new iPhone business, absolutely hands free by adding systems like Admob to your app!!