AAPL Financial News Weekly Roundup: Icahn's Letter, China Preorders and More

Submitted by Jon Reed on

Apple (NASDAQ: AAPL) share prices continued to hover around $100 over the course of last week's trading. Tuesday saw the low close of the week at $98.75, but prices rallied from there and closed at $100.73 on Friday. There could be an uptick this Thursday following Apple's media event. The company is expected to, at the very least, unveil the next generation iPad Air and a 27 inch Retina display iMac. OS X Yosemite will likely be released to the public as well.

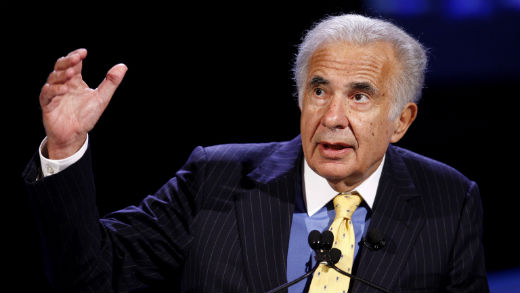

Perhaps the confidence in the latter half of the week resulted from Carl Icahn's extreme optimism. In a letter to Tim Cook titled "Sale: Apple Shares at Half Price," the billionaire investor urged Apple to buy back more stock at a faster pace. His reasoning lies in the fact that Icahn Enterprises' analysis of Apple concludes that the stock is "dramatically undervalued." By their numbers, Apple stock should be trading at around $203 per share.